How’s your performance so far YTD?

Have you been fighting the market? Are you sticking to your trading plan?

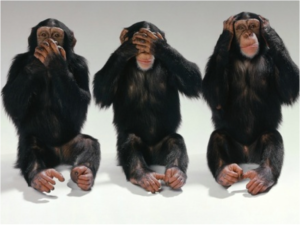

Are you making progress on any NYR you may have made? If you’re relying on post-it notes – “Follow My Plan”, “Be Patient”, “Don’t Be Greedy” etc., it’s not likely to lead to real behavior change.

Are you making progress on any NYR you may have made? If you’re relying on post-it notes – “Follow My Plan”, “Be Patient”, “Don’t Be Greedy” etc., it’s not likely to lead to real behavior change.

If you read trading psychology books and blogs, watch webinars, but then rely on Post-it notes as the actual strategy to change your behavior you are simply relying on hope that you will change. Likewise, telling yourself to be more patient and selective in your trades, that you’ll hold your winners longer or cut your losers faster is also a strategy based primarily on hope.

Hope is not an edge. In some areas of life hope may provide an edge, but not in trading. In fact, it’s often just the opposite. Change nothing and nothing will change. Post-it notes and hope are not enough.

It’s time to accept the idea that you are in fact trading an inner market just as much, if not more so, than the market you see on your screen. That’s why you veer from your plan and those post-it notes get ignored.

The dynamics within your inner market are behind the hesitation, the impulse trades, the doubling down on losers, the early exits to grab a small profit, and so on. Another way to say it….it’s the supply and demand dynamics within your own personal inner market that causes you to veer from your plan.

If you agree that the inner market is a big influence on your P&L, it is logical that the inner market is worthy of analysis. In other words, self-improvement for a trader often begins with self-reflection. (The caveat here is that you also have an edge in your trading method).

One of my coaching clients, I’ll call him Jason, had a major breakthrough in his trading. The breakthrough came after a key insight about his own inner market.

Early in the coaching, Jason learned how his need for perfectionism is behind his trading problems, and as is often the case, the problems continued anyways. Diagnosing the problem was not enough.

The big breakthrough for Jason occurred when he was able to analyze and understand the context of his anxiety, frustration, and fear in real-time as it was happening. When Jason was able to understand the context of his feelings, he recognized that the trade he was facing was simply a trigger of something deeper, his own inner market.

In Jason’s inner market, anything less than perfect was tantamount to complete failure.

For Jason, understanding that the roots of his perfectionism, and the anxiety that accompanies it may be triggered by the trade but actually goes well beyond the trade, allowed him to reach a new level of self-awareness and self-management that was previously elusive. No post-it note can achieve that.

The result is that Jason is not only able to recognize and understand his emotions and subconscious motivations driving his need for perfection, the strategy of self-analysis that he learned in the coaching has allowed him to accept that when he experiences intense anxiety or fear, he has options.

Jason’s big breakthrough is that he realizes that even in the heat of the moment he has a choice. He could fall back to his default pattern of behavior, or he could try something different. And for Jason, being aware of the real drivers behind his need for perfection is giving him the psychological space or breathing room to really consider what’s in his best interest as a trader.

Jason is doing great YTD, how are you doing?

Like many traders, Jason read a lot about trading psychology but after spending a lot of money on indicators, chat rooms, etc, he was hesitant to get help. A quote from Jason after his breakthrough…..”Quality isn’t expensive, it’s priceless”.

Leave A Comment

You must be logged in to post a comment.