‘I have to try harder to be more patient’

‘I need to be more disciplined taking my losses when I should’

Of course you do. But do you really think you will get there by simply making these promises to yourself? Most traders say these things to themselves and for most traders things just continue going the way they always go.

The reason things just continue the way they are in your trading is trying harder to be more patient or to be more disciplined when taking losses is akin to treating the symptom, not the root cause. You may get a little traction here and there by addressing symptoms; have a few good trades or perhaps a few good days or even a week or so, but eventually the problems return. You go off plan, you break all of those promises to yourself, you ignore the post-it notes.

How do you create sustainable change? The best way is to address the root causes. Addressing the root cause of the behaviors may be more challenging than making promises or re-writing your plan or printing out a new copy of trading rules. As my clients know, it’s well worth it.

Your trading performance shows how you respond to risk, opportunity, and uncertainty; it reflects your personality. As anyone who has traded on a simulator knows, when you transition to cash your trading changes, with real money on the line, the real you will take over. That’s why the focus has to be on what makes you tick, what makes you do the things you do?

My advice is to devote some time to learning what makes you tick, what causes you to move? Self-awareness is an excellent foundation for building discipline. Most traders who are frustrated with their performance will spend more time trying to figure out what causes the market to move, even if they have a sense that the problem is something within them such as being more patient or accepting losses.

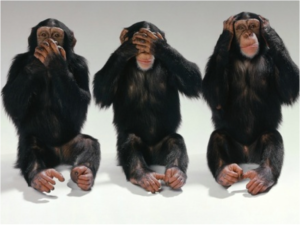

Markets move capital from one account to another. By developing self-awareness, you are gaining a more sustainable edge over other traders. Some of the best traders in the world know this. One successful hedge fund I’ve been to has a large picture of a ferocious looking shark to remind traders that it’s eat or be eaten.

Sign up for my free email newsletter that gives you free professional trading psychology tips every two weeks. If you’re ready to do something now about your trading performance, to go beyond the symptom and address the root cause please consider my self-paced Advanced Course, if you’re highly motivated contact me to discuss coaching.

Leave A Comment

You must be logged in to post a comment.